Circle of Competence: This is Why You Need to Stay in Yours!

Sadly, it seems like every other day you hear about ex-athletes going broke not long after retiring from their respective sport. The reasons are many – spending lavishly on homes, cars, and jewelry, as well as helping out family members and friends. Not to mention investing in or getting involved in business ventures for which they have no expertise.

According to former NBA player Chris Dudley in an article on CNBC.com: “At last look, an estimated 60 percent of former NBA players go broke within five years of departing the league.” 7

Hearing about ex-players like Vin Baker who lost almost $100 million in career earnings due to financial missteps and Antoine Walker who made over $108 million in his career yet had to declare bankruptcy due to the implosion of his Chicago real estate firm happens far too often. And it’s not just basketball players who have these financial problems, Dudley goes on to add that: “A reported 78 percent of former NFL players have gone bankrupt or under financial stress just two years after retirement.”

If only they knew about and followed the circle of competence, many of them would not be in the predicament they are currently faced with.

What is the Circle of Competence?

The circle of competence is a concept made popular by billionaire investor and CEO of Berkshire-Hathaway, Warren Buffett.

It is both simple to understand and to apply.

Simply put, the concept of the circle of competence involves finding out what you are good or competent at and sticking to that.

Buffett uses it in terms of investing in companies or areas that he has a solid understanding in, but it can be used in all areas of your life.

He described the circle of competence in his 1996 Chairman’s Letter to the shareholders of Berkshire Hathaway:

“Intelligent investing is not complex, though that is far from saying that it is easy. What an investor needs is the ability to correctly evaluate selected businesses. Note that word “selected”: You don’t have to be an expert on every company, or even many. You only have to be able to evaluate companies within your circle of competence. The size of that circle is not very important; knowing its boundaries, however, is vital.” 1

While the Term Circle of Competence May Have Originated with Buffett…

…the concept is not exactly a new one. In the Autobiography of Andrew Carnegie, Carnegie gives the following advice:

“I believe the true road to preeminent success in any line is to make yourself master in that line. I have no faith in the policy of scattering one’s resources, and in my experience I have rarely if ever met a man who achieved preeminence in money-making—certainly never one in manufacturing—who was interested in many concerns. The men who have succeeded are men who have chosen one line and stuck to it.” 2

In other words, stick to what you know and stick to what you are good at.

The Key Word in Buffet’s Paragraph Above Is “Boundaries”

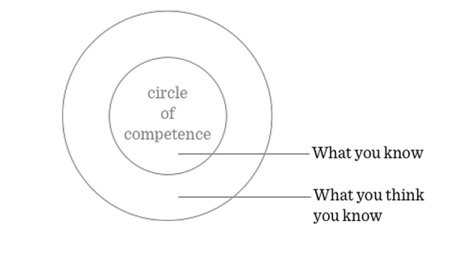

Understanding our boundaries is the most important part of the circle of competence. Seeing as how many of us are visual learners, let’s take a quick look at a diagram that explains the circle of competence visually:

How Do You Know if You Are Competent at Something?

I will let Buffett’s business partner Charlie Munger answer this one as he sums it up perfectly:

“If you have competence, you pretty much know its boundaries already. To ask the question (of whether you are past the boundary) is to answer it.” 3

Which is a more elegant way of saying, if you have to think about whether you are competent at something, you probably aren’t!

How To Use the Circle of Competence in Your Life…

Again, the idea is to understand your limitations and stick to those areas.

As Munger says,

“So you have to figure out what your own aptitudes are. If you play games where other people have the aptitudes and you don’t, you’re going to lose. And that’s as close to certain as any prediction that you can make. You have to figure out where you’ve got an edge. And you’ve got to play within your own circle of competence.” 4

Can We Widen Our Circle of Competence?

It is possible and often times desirable, but understand that it takes time and patience.

A few ways to increase our circle of competence are:

(1) Learning and reading:

As Munger says: “In my whole life, I have known no wise people (over a broad subject area) who didn’t read all the time – none, zero. You’d be amazed at how much Warren [Buffett] reads – and how much I read. My children laugh at me. They think I’m a book with a couple of legs sticking out.” 5

(2) Ask questions

Being curious is something that we all have as kids, but something that many of us lose as adults. By being curious and asking questions you can increase your circle of competence.

(3) Learn from the mistakes of others

Watch and learn from what others do. Whatever you want to do odds are someone else has done it and made mistakes you can learn from. One of my favorite Munger quotes is, “You don’t have to pee on an electric fence to learn not to do it” 6

(4) Delegate or Outsource

Sometimes it isn’t possible or worth your time to widen your circle of competence. It comes down to whether your time is best spent somewhere else – which is a question only you can answer. But remember you can’t nor should you try to do everything. Sometimes it is better to let someone who has that competence do it.

Real-life Examples of the Circle of Competence

A few real-life examples of the circle of competence:

Investing – be wary of investing in areas you have no knowledge in.

Applying to jobs – taking jobs in areas that we don’t know enough to be competent, which ends up being a nightmare for all involved. Know your limitations.

Managing others – by understanding your employee’s circle of competence, you can help put them and the company in the best position to succeed. You can also use it to figure out what they need to improve.

Personal life – be wary of engaging in tasks that you have no business being engaged in. For example, if you know nothing about exercising, get a personal trainer to teach you how to exercise properly.

Well, that’s it for today’s post. Speaking of basketball, I think I am going to go work on my jump shot – being an NBA player seems like fun and it sure pays well!

On second thought, perhaps I’ll stick to blogging, as it is in my circle of competence…

Until next time, stay within your circle of competence, watch out for electric fences and as always…PYMFP!

–Rick

If you enjoyed this post, it would mean the world to us if you shared it with people you care about via any of the social media platforms below!

Popular Previous Posts:

Managing Yourself: Advice from the Great Peter Drucker

How Many of These 5 Essential Questions Do You Ask?

3 Quick Ways to Become a Talent Magnet!

So, Do You Have a Fixed or Growth Mindset?

References

1 http://www.berkshirehathaway.com/letters/1996.html

2 Carnegie, Andrew, 1835-1919. (1920). Autobiography of Andrew Carnegie : with illustrations. London :Constable, Ltd.,

3 https://www.azquotes.com/quote/962749

5 http://www.quoteswise.com/charlie-munger-quotes-2.html

6 https://www.goodreads.com/quotes/7609885-you-don-t-have-to-pee-on-an-electric-fence-to

7 https://www.cnbc.com/2018/05/14/money-lessons-learned-from-pro-athletes-financial-fouls.html

Part 1 – I read your message from yesterday afternoon. Thanks for the compliments, but like I often say “I call it as I see it”. Remind me never to take a job as an NFL referee. I had initially thought about deleting that whole section – that’s all I need is for you all to get pissed off at me. Glad you guys took it at face value, a very simplified comparison without trying to be judgmental.

Part 2 – Today’s essay should be mandatory reading for all professional athletes. I am reminded of a conversation I had with a fellow employee shortly before I retired. He says to me “I can recommend a good personal financial adviser if you are interested”. This coming from a guy who was in hock up to his ass, he was living the life style to which he wanted to become accustomed; and was sinking rapidly. I replied to his offer quite simply “Thanks for the offer, but I am my own financial adviser, and always have been.” Which is true, and I have done quite well.

The keys to successful investing are research, reading, and asking questions. I dabble in antiques and collectibles, and have one basic rule – If I know more than the dealer, I cannot lose. Buy something for 300, turn around and sell it the next month for 1200. At an auction, buy what’s called a ‘box lot’ to obtain one item in the box, take that item out, and re-consign the box. I have done that more than once. Several bookcase shelves are crammed with books on antiques, and catalogs of past sales. I refer to them often.

Regarding the stock market, I do not invest, with one exception. Lockheed offered a stock option plan which I signed up for, with dividend re-invested. At the time, shares were 55 apiece. At 120, the stock split. Last I looked, I now own over 800 shares, and just for shits and grins, last Friday’s paper valued a share at 307.

These athletes, fresh out of a college from which they did not graduate, get a butt-load of cash dumped in their laps. They have no concept of money, and think the flow will never end. Of course it does, sometimes sooner or sometimes later. There’s a pile of debts, probably legal costs, creditors beating on your door, maybe even threats from the mob. Declare bankruptcy, and because you are ignorant and sometimes cannot even speak English properly, realize the only job you are qualified for is “do you want fries with that”. And that you are screwed permanently. And its your own fault.

Let’s sum it up in rather basic terms: for a given unit of time (month, year) income must exceed outgo. I have no financial worries, and can set back and enjoy. Not too shabby for someone who as a kid, learned about life on the mean streets of the West Bronx.

Hi Dave, We always value your opinion so never feel you need to delete anything with us – we all see things differently and that is how we learn and make each other better! I like your antiques example, it is a good one. That is pretty damn sweet about Lockheed, love it! Be good, Rick