This is Why It’s So Important to Take the Outside View!

Anyone who follows horse racing in the United States is familiar with the Triple Crown. To win the Triple Crown, a horse must win the Kentucky Derby, the Preakness Stakes, and the Belmont Stakes on 3 different tracks that are all different lengths and all within a 5-week period. Prior to Big Brown’s attempt in 2008, only 11 horses had done it in the previous century and none within the previous thirty years.

However, after winning the Kentucky Derby by four-and-three quarter lengths and the Preakness Stakes by five-and-one quarter lengths, Big Brown’s trainer Rick Dutrow was certain his horse would win the Triple Crown:

“It’s a foregone conclusion,” claimed Dutrow

Not surprisingly, Dutrow was not alone in his confidence that his horse would win the Belmont and claim the Triple Crown. The rest of the field was mediocre and his biggest competitor, Casino Drive, pulled out of the race at the last minute. Evidence of the enthusiasm for Big Brown included attendance being double the previous year, UPS purchasing a logo on Big Brown’s outrider, and most of the prognosticators picked him to win the race.

So, how do you think he did? The only clue I am going to give you is that those who believed it was a no-brainer that he would win had taken what is called the inside view. And they had failed to take what author Michael J. Mauboussin calls the outside view into consideration.

Wait…before you answer

Let’s look at his chances from a couple of other perspectives:

(1) How Did Previous Triple Crown Contenders Fair?

In his great book, Think Twice: Harnessing the Power of Counterintuition, Mauboussin presents some interesting Triple Crown statistics:

“Of the twenty-nine horses with a chance to capture the Triple Crown after winning the Kentucky Derby and the Preakness Stakes, only eleven triumphed, a success rate less than 40 percent. But a closer examination of those statistics yielded a stark difference before and after 1950. Before 1950, eight of the nine horses attempting to win the Triple Crown succeeded. After 1950, only three of twenty horses won. It’s hard to know why the achievement rate dropped from nearly 90 percent to just 15 percent, but logical factors include better breeding (leading to more quality foals) and bigger starting fields.” 1

(2) But What About Big Brown’s Innate Ability and Impressive Track Record?

The next question is, what about the talent on the individual horses? All the horses in position to win the Triple Crown surely had differing levels of talent.

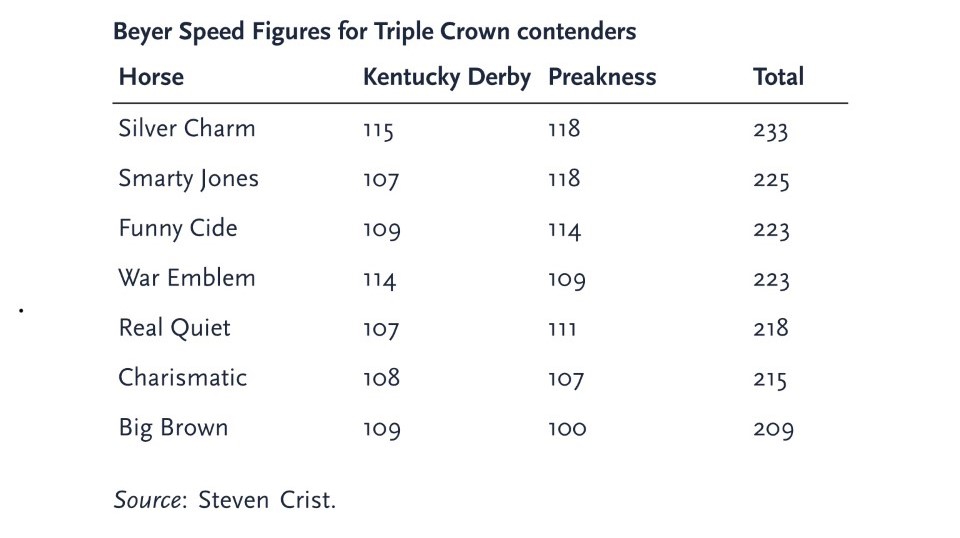

One way to compare horses is to use what is called the Beyer Speed Figure that you see below for Triple Crown contenders. As Mauboussin says, “One way to compare horses is the Beyer Speed Figure, which assigns a number to a horse’s performance based on the time of the race and the speed of the track given the weather conditions. Higher speed figures are better.” 1

So, Now What Do You Think…

…after looking at those two new perspectives on Big Brown’s chances to win?

What do you think happened?

Well, as I am sure you have guessed by now, he did not win. But what you may be surprised to learn is that not only did he not win – he finished dead last! And that is something no other Triple Crown contender had ever done.

The story of Big Brown is a great example of what can happen when we favor the inside view over the outside view.

The Inside View Versus the Outside View

Let’s quickly differentiate between the inside view and the outside view.

As Mauboussin says:

“An inside view considers a problem by focusing on the specific task and by using information that is close at hand and makes predictions based on that narrow and unique set of inputs. These inputs may include anecdotal evidence and fallacious perceptions. This is the approach that most people use in building models of the future and is indeed common for all forms of planning.” 1

This is what Big Brown’s trainer and everyone else did in assuming his previous wins and imposing physical appearance would make him a shoo-in to win.

On the other hand, Mauboussin explains the outside view as follows:

“The outside view asks if there are similar situations that can provide a statistical basis for making a decision. Rather than seeing a problem as unique, the outside view wants to know if others have faced comparable problems and, if so, what happened. The outside view is an unnatural way to think, precisely because it forces people to set aside all the cherished information they have gathered.” 1

Those handicappers who used an outside view looked at Big Brown concluded he had a lower probability of winning than was on the tote board after looking at how other horses in the same spot had fared.

Why Do We Embrace the Inside View?

There are 3 illusions that cause us to embrace the inside view:

(1) We have an unrealistically positive view of ourselves – most of us think we are above average in comparison to others. However, if you look at it statistically, 50% of us are below average!

(2) The illusion of optimism – we see our futures as being brighter than those of others.

(3) The illusion of control – we behave as if chance events are within our control.

Some Real-Life Examples

Prior to giving several examples on how we rely on the inside view to make decisions, Mauboussin prefaces it with: “A vast range of professionals commonly lean on the inside view to make important decisions with predictably poor results. This is not to say these decision makers are negligent, naïve, or malicious. Encouraged by the three illusions, most believe they are making the right decision and have faith that the outcomes will be satisfactory.” 1

A few examples he gives are:

Mergers and acquisitions

While corporate mergers and acquisitions are a multitrillion-dollar global business, that doesn’t guarantee they create value for shareholders. In fact, researchers estimate that the company who does the acquiring sees their stock go down roughly two-thirds of the time. According to Mauboussin, “The explanation is that while most executives recognize that the overall M&A record is not good, they believe that they can beat the odds.” 1

Medical treatments

Mauboussin gave the example of his own father who was falling out of options after being diagnosed with late-stage cancer had opted for an alternative treatment. As he says “It didn’t take long to do the research. No well-constructed studies had shown the treatment’s efficacy, and the evidence in favor or the approach amounted to a collection of anecdotes.” 1 While it’s great for patients to be engaged and involved, many times they fall victim to be influenced by sources who rely mostly on anecdotes rather than the scientific evidence.

Planning fallacy

The last example is one we discussed in a previous post on the planning fallacy. The planning fallacy is a type of optimism bias which causes us to underestimate how long it will take us to complete an upcoming project or task. In other words, as humans, we are REALLY BAD at estimating how long it will take us to do things! Our best bet to counter the planning fallacy is to find similar previous past projects to see how long they took and then to adjust our baseline prediction accordingly.

How to Use the Outside View to Make Better Decisions

Mauboussin gives a 4-step process for how to incorporate the outside view into your decision making which he has distilled from the 5-step process of Daniel Kahneman and Amos Tversky:

(1) Select a reference class.

In other words, identify a group of similar situations that are broad enough to be statistically significant but narrow enough to help you make the decision you are faced with. Look at the details to see which types succeed.

(2) Assess the distribution of outcomes.

Next, look at the rate of successes and failures for the reference class you selected. Examine the distribution and take note of the average result, the most common result, and extreme successes or failures.

(3) Make a prediction.

Third and with some data from your reference class in hand, including an understanding of the distributions, it is time to make a forecast. At this point, you need to estimate your chances of success and failure. As we have seen, the odds are good that your prediction will be too optimistic.

(4) Assess the reliability of your prediction and fine-tune.

Lastly, the idea is to use specific information about the current decision to adjust your baseline prediction toward the average (or whatever other statistical measures).

Some May Say…

…that Big Brown’s performance was simply due to what Arthur Bloch calls Harvard’s Law which states:

“Under the most rigorously controlled conditions of pressure, temperature, volume, humidity, and other variables, the organism will do as it damn well pleases.” 2

Other’s may say that if you have taken the outside view, the results were predictable all along!

Until next time, take the outside view and as always…PYMFP!

–Rick

P.S. Wanna know more? Check out the entire book.

Use it or Lose It

The 4-step process for how to incorporate the outside view into your decision making is as follows:

(1) Select a reference class.

(2) Assess the distribution of outcomes.

(3) Make a prediction

(4) Assess the reliability of your prediction and fine-tune.

When to Use It

Use the outside view when making important decisions in your life.

What Do You Think?

Can you think of an example when you made a decision based on the inside view in your life? How about the outside view? Please share your thoughts in the comments below!

If you enjoyed this post, it would mean the world to us if you shared it with people you care about via any of the social media platforms below!

Popular Previous Posts:

The Science Behind the Multitasking Myth and How to Avoid It

Brain Rules: This is How to Use Your Brain Better!

Starting Your Career: 8 Successful Strategies to Employ!

This is How to Use ‘Fear-Setting’ for Overcoming Your Fears

References

1 Think Twice by Michael J. Mauboussin

2 Arthur Bloch, Murphy’s Law: The 26th Anniversary Edition (New York: Perigee Trade, 2003), 70-71

It makes me think of when my children were very young and I would want them to be well behaved . I have to say they were usually very good even when I took them to church. However, on one occasion my daughter noticed that there were candles lit. She thought it was someone’s birthday and started singing ” Happy Birthday” as loud as her little voice could muster. This affirms the Harvard theory that we don’t know how an organism will react when conditions change. Lol

Hi Eileen, Hahaha – that’s a great story and a great example of the Harvard rule. Thanks and take care, Rick

I have absolutely no interest in horse racing, or for you Florida folks, dog racing. But I do have an interesting theory about sports betting – on a potential close game in college basketball (teams are about equal), bet the underdog if the spread is 5 points or less. No, I have never tracked the results over time, but it seems to work for me more often than not when I’m in Vegas. Nuff said about that.

So….

(1) I do believe I am above average, as I’m sure you do also.

(2) I do believe my future is bright, because I have planned for it.

(3) Chance events are never within a person’s control.

Harvard’s Law – had not heard that one before…Love it.

Hi Dave, interesting re: your theory – it would be interesting to see how it shakes out with data, but as long as you are coming out ahead over time that’s all that counts. Agreed with #1, for sure I think I am better than average BUT therein lies the problem. If we all think like that, then half of us are wrong because as Howie says, “by definition half of us are below average.” Have a great Tuesday! Rick